|

NAB executives should be obsessed with working for customers, interim chief executive Phil Chronican said as he promised change at the scandal-hit lender.

Mr Chronican started in his post on Friday following the abrupt resignation of his predecessor Andrew Thorburn, who was last month criticised in the financial services royal commission's final report. In an internal email sent to the bank's 100 most senior executives on Thursday, Mr Chronican said he agreed with the Royal Commission's finding that NAB was not meeting the expectations of its key stakeholders. "We are the bank's most senior leaders: we need to run the bank - and we need to change it," wrote Chronican, who was a non-executive director on the NAB board when tapped for the interim role. "We need to bring the same obsession to customer outcomes that airline companies do to safety." His first day in the top job coincided with the arrest of a former supplier accused of defrauding NAB of millions of dollars. NAB said it was cooperating with police, with the alleged fraud involving a former staff member. "If the alleged fraud is proven, it represents a most serious breach of trust by a former employee," the bank said in a statement on its website. During the royal commission, the bank admitted its subsidiaries wrongly charged fees to thousands of customers without providing them with services. In his email to executives, Chronican also said the bank was focused on ensuring fair compensation to customers for its wrongdoing. "I am focused on making sure we compensate customers as quickly as possible; and on fixing the issues that caused the failure." The rate of house price declines slowed in February, but not by enough to dissuade economists that Reserve Bank rate cuts are just around the corner.

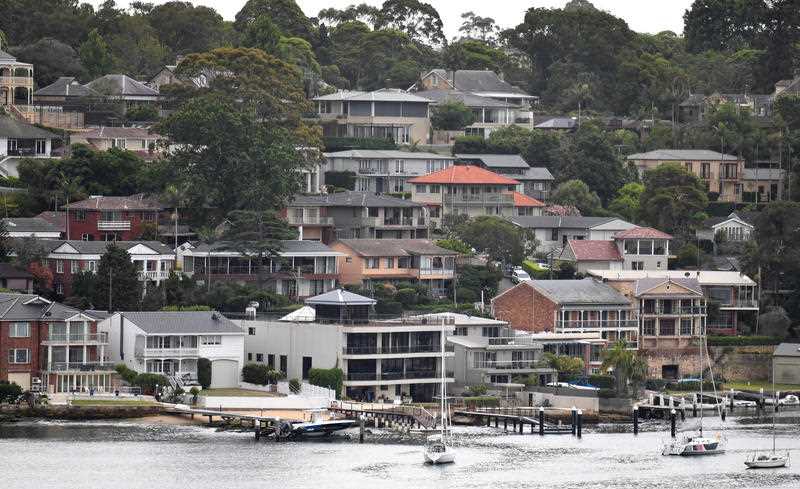

The national median home price fell 0.7 per cent in February to $524,478, according to data released Friday by CoreLogic, a level last seen in September 2016. That's down 2.7 per cent for the quarter and 6.3 per cent for the year, although the monthly decline eased relative to those recorded during the traditionally slow December and January months. But despite last month's bounce for Sydney and Melbourne's auction clearance rates, and a slowing in momentum in monthly price declines, AMP Capital chief economist Shane Oliver said he was doubtful it meant the property market was stabilising just yet. "Ongoing home price falls in Sydney and Melbourne will depress consumer spending as the wealth effect goes in reverse and so homeowners will be less inclined to allow their savings rate to decline further," Dr Oliver said. "It’s also a negative for banks and is consistent with our view that the RBA will cut the cash rate to one per cent by year end, starting around August." He said the pricing weakness is now at levels lower than when then RBA started cutting rates in 2008 and 2011. Dr Oliver anticipates an overall 25 per cent top-to-bottom fall in Sydney and Melbourne, with prices bottoming out in 2020. CoreLogic head of research Tim Lawless cited tightening credit as having a broad dampening effect on buying activity in regions that previously experienced rising prices at a sustainable pace. Hobart was the only capital city to record a rise in February and in the quarter, lifting 1.1 per cent over the past three months to $457,186. It's also the annual leader with a 7.2 per cent rise. Housing prices in Sydney led the decline annually, down 10.4 per cent to an average of $789,339 - for its first double digit annual decline since the early 1980's. Melbourne closely followed at 9.1 per cent lower to $629,457, with Mr Lawless saying double digits are also on the horizon for the Victorian capital. CoreLogic blamed the substantial Sydney and Melbourne declines on the long-running reduction in investment lending. Demand for rental properties across every capital city apart from Darwin prompted weekly rents to edge higher over February. ANZ has overhauled its leadership structure in Australia following last year's departure of retail chief Fred Ohlsson, giving two executives joint responsibility for the bank's local financial performance.

Mark Hand has been named Mr Ohlsson's permanent successor as retail chief, and digital banking boss Maile Carnegie is taking on an expanded role as digital and Australia transformation executive. The pair will jointly share responsibility for ANZ's financial performance in Australia, which chief executive Shayne Elliott indicated was a response to the challenges posed by the financial services royal commission. "It was clear that retaining a single governance and accountability structure is no longer suitable given the size and complexity of the challenges facing domestic banking in Australia," Mr Elliot said in a statement. Mr Ohlsson, who was ANZ's NZ boss before becoming Australia group executive in 2016, stepped down on December 29. He assisted Mr Hand throughout January. Ms Carnegie joined ANZ in 2016 after working for Google as managing director in Australia and New Zealand following 20 years with Proctor and Gamble. The structural changes to the executive management team will come into effect from March this year. The changing state of Australia's housing market may be occupying the minds of many property owners, but cooling prices in big cities are not worrying Treasury.

House prices fell by 4.8 per cent nationally in 2018, according to CoreLogic data, and are expected to continue declining this year. But Treasury secretary Philip Gaetjens says as long as prices don't drop steeply, his department isn't stressed. "As long as it’s not a sharp correction, I don’t think it’s a problem," he told a Senate estimates hearing on Wednesday. “I don’t think from a policy point of view, there’s much concern." Mr Gaetjens said all housing markets go through cycles, with prices in Sydney and Melbourne climbing in recent years amid high demand. That caused some issues for people wanting to buy their first property and regulators monitoring the quality of credit lenders were offering. The Treasury boss said recent price declines reflect efforts by regulators such as the Australian Prudential Regulation Authority to improve the quality of credit offered. “We’re looking at results that I think are consistent with the policy objectives of those regulators.” |

ArchivesCategories |